accumulated earnings tax irs

IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or. Write From Form 4970 and the amount of the tax to the left of the line 8 entry space.

Q17 Iaetrfcnrfc Ans Pdf Income Tax Dividend

Accumulated Earnings Profits EP of Controlled Foreign Corporation.

. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid. 1 Accumulated taxable income is. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

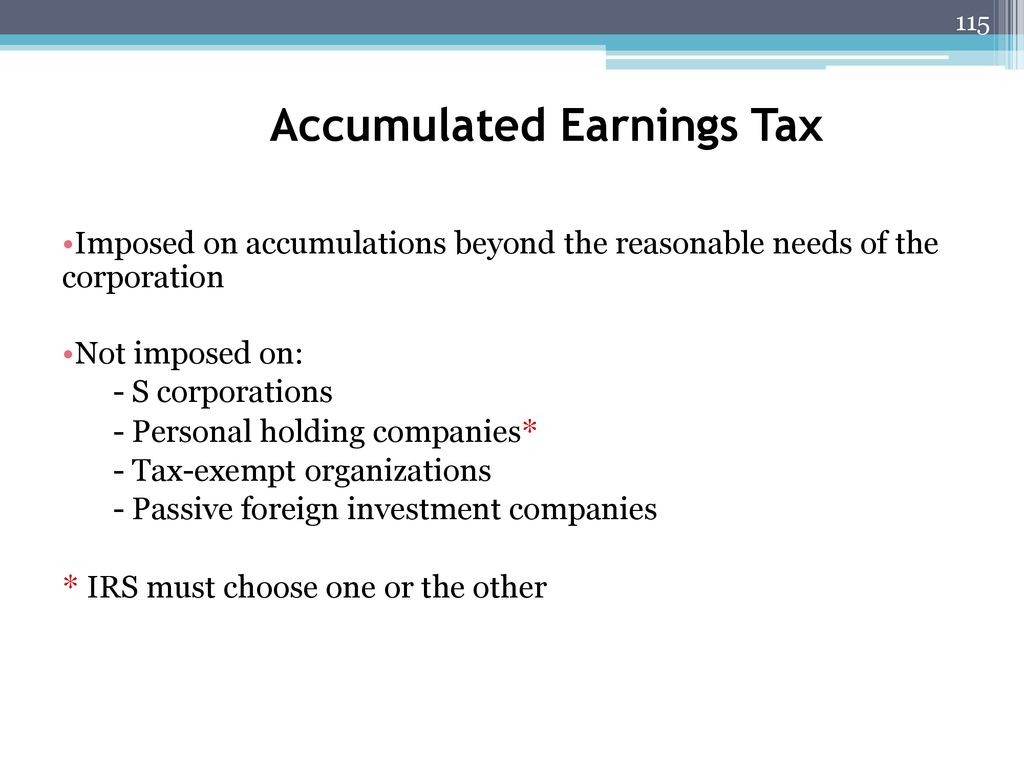

Accumulated Earnings Tax. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. Add the result to the total tax liability before the refundable credits on your income tax return.

The purpose of the tax. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of. For instructions and the. The tax is assessed at the highest individual tax rate.

The accumulated earnings tax AET was put in place to prevent corporations from doing just that. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. However if a corporation allows earnings to accumulate. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. Attach to Form 5471. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

If the IRS finds that a corporation is accumulating income for the purpose of. The tax rate on accumulated earnings is 20 the maximum rate at which they would. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business.

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Earnings And Profits Computation Case Study

Corporate Tax Copyright Ppt Download

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

Form 5471 Schedule J Accumulated Earnings Profits E P Of Controlled Foreign Corporation Youtube

Avoiding Missteps In The Lifo Conformity Rule

Schedule J Accumulated E P Of Cfc Irs Form 5471 Youtube

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

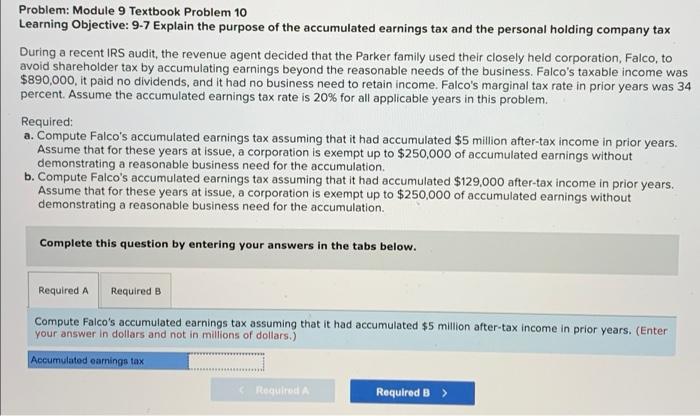

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube